Three and a half years ago, we decided to incentivize aggressive saving and demonstrate the power of compound interest to our kids by offering them exclusive access to the Bank of Mom and Dad. That experiment, we are pleased to say, has thus far been a success.

We gave them a sweetheart deal for maximal impact: 5% interest compounded monthly.

To give you an idea of just how good that offer is, if you begin with $100 and compound it monthly for a year at 5%, making zero additional deposits, you end up with $179.59, nearly doubling your money in a year. If you start with $500 under identical circumstances, you end the year with $897.93.

Certain entities can be manufactured without being easily replicated: I'm thinking of the highly unstable atoms that adorn the end of the periodic table, whose synthetic existence in a lab is fleeting at best (Nobelium-254 has a half-life of 3 seconds). Our extremely high interest rate was clearly not going to be found occurring in the real world.

We wanted the kids to witness what passes for a geologic time event in an accelerated manner, providing a time-lapse video of their growing bank accounts. We assumed change needed to occur rapidly to register as meaningful in the minds of what were then a 7 and 9 year old.

We established a tradition of labeling the first of every month Compound Interest Day, where we would give a report of their investments and the interest they had earned. I'm pleased to report the monthly tradition continues to this day. As they witnessed their net worth increase, the kids became more aggressive about saving.

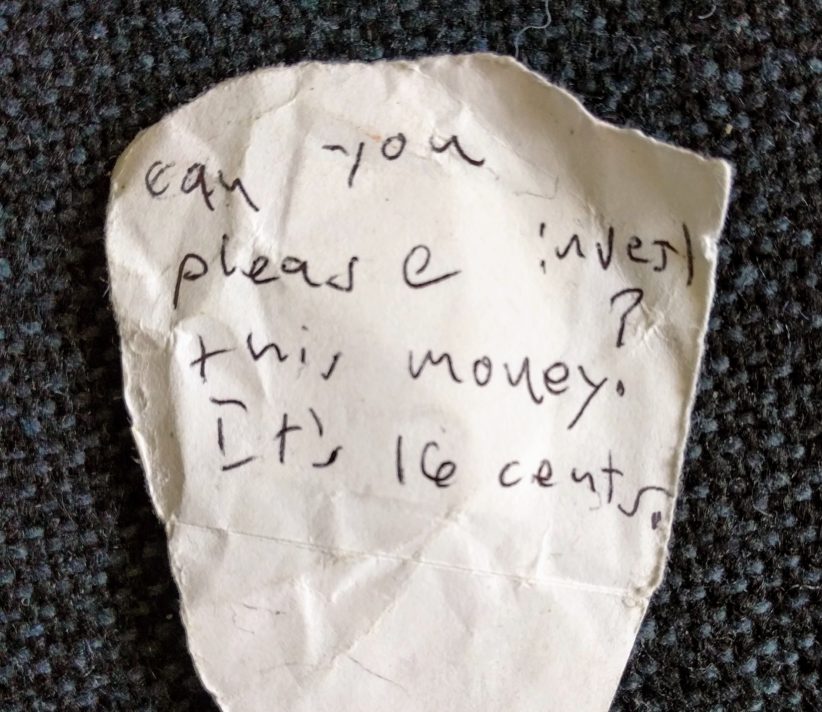

Pennies and nickels found on the elementary school yard were brought directly to me for immediate deposit on the day of discovery. $20 bills during visits by grandparents, formerly left to molder in piggy banks, were instead given directly to me for investment. Although they didn't know the term for it, they quickly grasped the concept of cash drag.

The Bank of Mom and Dad also produced minimalist dividend in our home as well. Birthday gifts could be either opened and enjoyed or, alternately, redeemed for a deposit credited at the going value on Amazon (at which time they would be promptly placed in the re-gift section of a storage closet). This reduced clutter in the kids' rooms, trending toward fewer, higher quality items they used more often.

A low grade competition developed among the kids, with my son eager to vault his net worth above his sister's (he's narrowing the gap, to his great delight). This did not mean that the kids became misers; instead, they became more intentional about their purchases.

Birthdays and holidays that had previously enabled spendthrift behavior were now transformed into opportunities to invest or exercise delayed gratification. My son might spend hours poring over lego sets to determine which single large set he might want to save up and purchase using his combined birthday and holiday gift money - investing roughly half and spending the other half.

Once their savings hit a designated threshold, we stopped subsidizing their investments and transferred their holdings from the Bank of Mom and Dad to the stock market to learn about passive investing in index funds. My daughter is invested in VTI, my son in VOO. I hope to use these funds someday to help them out with milestone purchases (a first car; as part of a home down payment), but opted not to start an UTMA account so as to retain control over it, at least for the time being.

This was helpful, as they rode the highs of irrational exuberance, endured their first significant correction this past March, and then watched the market rebound. They were able to taste volatility, and that was valuable. While concerns regarding the long-term viability of passive index investing as an investment strategy are understandable, it seemed a safe and reasonable way to introduce grade-school children to complex investing concepts and experiences.

My daughter's net worth has increased 15-fold over the trial period, my son's has increased nearly 22-fold. Each has a net worth in the low 4 digits.

When they receive gifts, they trade-in anywhere fro one quarter to one half for credit that applies to purchasing more shares in their respective ETFs. Cash gifts most often get deposited, although with adolescence my eldest has asked to hold onto more cash gifts.

I suspect retaining cash provides an important sense of control over destiny at a time where COVID has called that control into question. Since we also mandate pre-approval any purchases made using Bank of Mom and Dad funds, it's a clever way our adolescent has found to potentially bypass parental supervision. I am equal parts proud and terrified of that acumen.

Overall, we have cultivated two young savers and helped them transition into investors. They've established a practice of delayed gratification; thoughtful advance consideration of purchases (a behavior the psychology data suggest leads to increased satisfaction with one's purchases); and they've both developed a bias toward putting money to work earning more money.

Do we have regrets? We have not emphasized philanthropy enough. I need to make giving to those in need a more central and visible part of their (and my) practice, as most of it occurs behind the scenes using our donor-advised fund.

This will be the emphasis of our next course-correction in teaching the kids about finances.

What have you done to avoid screwing up your kids' relationship with money? What worked out well, and what do you anticipate will require years of therapy?