I've written previously about my attempts to teach our children about investing in order to demonstrate the value of letting your money work for you.

With the raging bull market, it had been an easy lesson, since every time we checked their investments they could see gains. Now comes the greater challenge.

How can I teach my kids to stay the course through corrections and bear markets?

When we started their financial education, they earned interest through the extremely high yield Bank of Mom and Dad. This reinforced the value of saving.

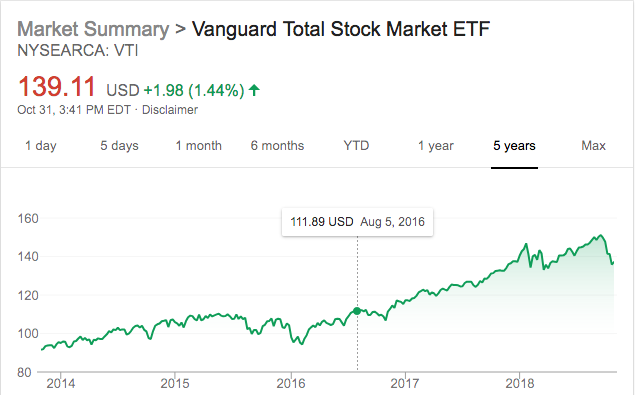

Once their investments reached an agreed upon threshold, each child had their savings invested in a Vanguard ETF that reflected extremely low cost, passive index fund investing. My daughter is in VTI, my son in VOO.

The first of each month is Compound Interest Day in our household. We sit down to review their investments and add in any savings or subtract any expenses.

When they save enough to purchase another share of the ETF, we buy more.

How did we deal with the recent drop in their investments?

We looked at trends over time.

First we graphed the performance of VTI over the past month.

The kids looked frightened.

Next, we graphed the performance of VTI over the past 6 months.

The kids were less scared, but sullen that they had lost any gains over that time period for essentially flat performance.

Finally we looked at the performance of VTI over the past 5 years.

Now they smiled in recognition of the upward trajectory they'd grown accustomed to.

Both kids seemed to understand the take home messages:

- Corrections, bear markets, and short-term volatility are natural elements of normal market cycles.

- Over a long enough time horizon, the market always goes up.

- There is wisdom in becoming an Oblivious Investor.

How are you preparing your kids, mentees, colleagues or spouse to stay the course?