One of the most enjoyable ways I’ve channeled my finance geek leanings has been to offer to meet with newbies who join our practice to review their finances and help them develop confidence in a plan to pay off educational debt, invest, and save for retirement. For a surprising number of them, it’s the first such discussion they’ve ever had, and they welcome the opportunity to learn.

The newbies seem to get more motivated to meet once they look at the group schedule to find a time when both of us will be off – and promptly take note of the fact that I’m working fewer shifts than most other colleagues at my career stage. After the conversations I enjoyed this past weekend, apparently the newbies aren’t the only ones taking notice.

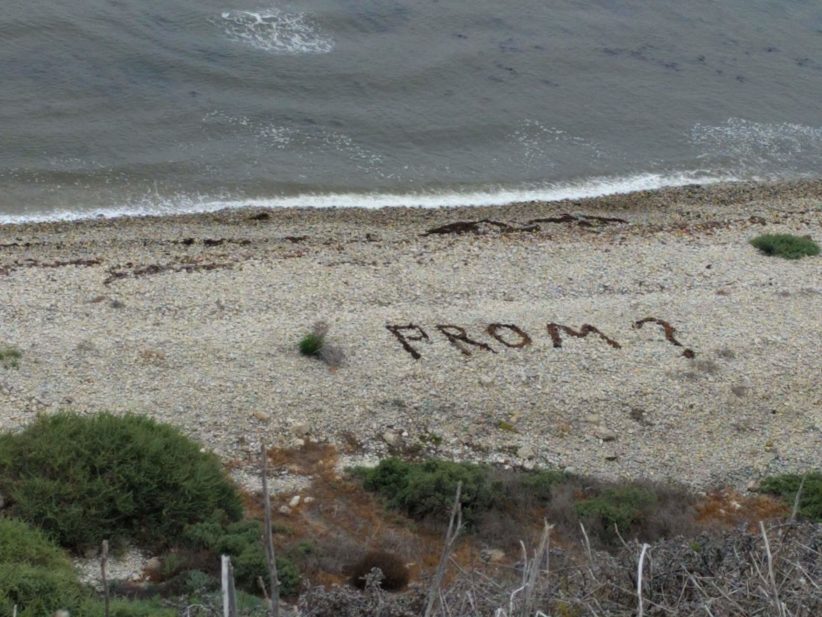

We’ve attended various community events that over the years, lavish affairs equivalent to an amplified teen dance except the attendees have salt-and-pepper hair. Better than any high school dance, my date (my wife) is a terrific dancer, she only wants to dance with me, and I know I’ll take her home tonight! Every event is like living the happy ending of a John Cusack movie from the 80s minus the adolescent insecurity.

My wife and I take special pride in dressing the part without paying retail – her formal dresses are from clothing exchanges or thrift stores. My proudest moment was a last-minute shopping spree to Macy’s a decade ago that netted me a pair of slacks off the clearance rack for exactly one penny, a story now embedded in our family frugal lore.

Our group makes a charitable contribution each year to support a local shelter for mothers in transition leaving abusive relationships. As thanks, we receive a few complimentary seats to the organization’s annual fund-raising gala. This year we drummed up interest among several friends in my practice to join us, and had a terrific time catching up.

I genuinely like the people I work with, but the nature of our job has unfortunately eliminated much of the social interaction that used to accompany the work. The volume of patients, need to satisfy metrics to demonstrate our value to administration, and continuous encroachment of marginal “efficiencies” have taken away the check-in opportunities that are so critical to building camaraderie with the docs, nurses and techs on the ED team.

This makes these events that much more critical as a chance to check in with people I work with and care about but don’t have time to deeply connect with on the job. No fewer than four emergency physician friends (ages late 30s to mid 40s) began to pepper me with questions about exit strategy and sustainability. One parent recently survived an unexpected cancer diagnosis requiring major surgery (fortunately caught extremely early, stage 1). Another is sandwiched between a big brood of kids with the oldest about to enter primary school while serving as the primary support to two parents with cancer on chemo. A third admitted to burnout due to the frenetic pace and high volumes combined with time away from young kids.

They asked questions about how I was able to cut my shift load down, what I was doing with the extra time, and where I wanted to be. We confided ambitions, small victories, insecurities, and disappointments.

During one conversation, I found myself articulating something I hadn’t quite put into words before. That if I were to choose a second act after medicine, it might be helping new docs square away their finances to set them up on the path for successful careers.

The friend I was speaking to is particularly good at helping me refine fuzzy thoughts into actionable plans, and she asked me to clarify. I realized it would probably be working with folks who find me through the blog and want someone to set them up with a debt repayment schedule, select an asset allocation that properly reflects their risk tolerance and goals, and explain how to create the proper investing vehicles (solo 401k, backdoor Roth IRA, HSA) so that they can continue on autopilot.

This was an incredibly energizing concept. After thanking my friend, I drove home brainstorming a ten-year plan to get me from here to there. I’m making a to do list for how to take the blog from a vanity project to a viable (if initially small scale) entrepreneurial endeavor. I’ve hired a graphic designer to create a logo more sophisticated than the one I paid 12 bucks for last year. I’m going to teach myself a bit more about how to get the blog in front of more eyeballs, taking notes from the generous tips for bloggers published by successful veterans like PoF, Joe at Retireby40, Jeremy at GoCurryCracker, and ESI. And I’m going to refine what have been informal notes I hand to friends who ask for my help into a deliverable package of materials that someone could refer to on a regular basis going forward.

Lots of exciting thoughts percolating through my brain right now. This could be the second act that helps me retire to something meaningful, flexible, location independent and income-producing. A passion project that keeps me learning new skills and growing in new directions. Stay tuned…